Nickel is one of the most essential elements in stainless steel, and its impact on the pipe, valve, and fitting (PVF) industry is profound. For wholesalers, understanding nickel’s role in stainless steels' composition, pricing, corrosion resistance, and global market dynamics can directly influence inventory strategy, customer guidance, and profit margins.

Nickel is one of the most essential elements in stainless steel, and its impact on the pipe, valve, and fitting (PVF) industry is profound. For wholesalers, understanding nickel’s role in stainless steels' composition, pricing, corrosion resistance, and global market dynamics can directly influence inventory strategy, customer guidance, and profit margins.

In this blog, we will look at whether stainless steel contains nickel, how much it contains in popular grades, the metal's corrosion-resistant properties, the competitive demand for nickel, and the implications of market volatility.

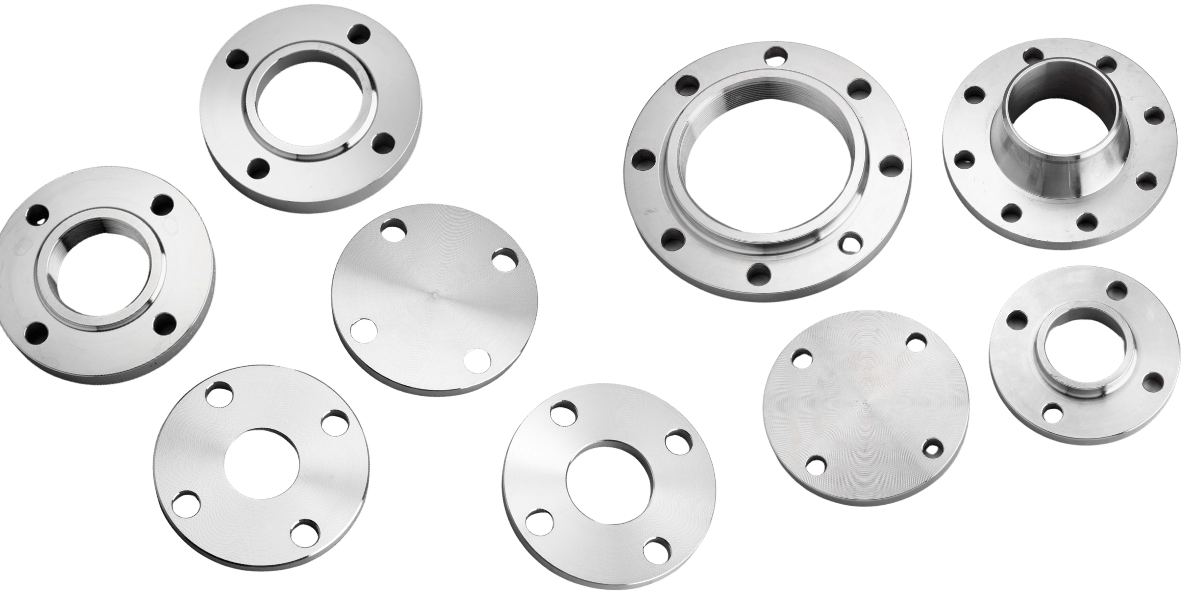

Most stainless steel contains nickel. Specifically, austenitic stainless steels such as Type 304 and Type 316, which are widely used in the PVF industry. They rely on nickel to enhance corrosion resistance and mechanical performance.

Nickel stabilizes the austenitic microstructure of stainless steel, which leads to toughness, ductility, and resistance to stress corrosion cracking. This makes it indispensable for piping systems exposed to harsh chemicals, saltwater, or extreme temperatures.

However, not all stainless steel grades contain nickel. Ferritic stainless steels, such as grade 430, are low in or free of nickel. These grades are less corrosion-resistant and typically used in less demanding environments.

Stainless steel containing nickel is typically preferred in industries like oil & gas, water treatment, chemical processing, and pharmaceuticals. Understanding which stainless steels contain nickel helps wholesalers guide customers based on performance requirements and budget constraints.

Different stainless steel grades contain different amounts of nickel, affecting both performance and price. Below is a comparison of the most used stainless steel grades in PVF applications.

|

Grade |

Nickel Content (%) |

Applications |

Cost Tier |

|

304 |

8.0 – 10.5 |

General-purpose piping, food processing equipment, tanks |

Medium |

|

316 |

10.0 – 14.0 |

Marine, chemical plants, pharmaceuticals, and high-corrosion settings |

High |

|

316L |

10.0 – 14.0 |

Welded piping, pharmaceutical and biomedical applications |

High |

|

430 |

~0.5 |

Decorative applications, indoor environments |

Low |

304 stainless steel strikes a balance between performance and cost, making it a common choice for general piping.

304 stainless steel strikes a balance between performance and cost, making it a common choice for general piping.

For environments with high salinity or acidity, 316 and 316L stainless steel are better suited thanks to their higher nickel content and enhanced corrosion resistance. 316L is particularly valuable in welded systems due to its low carbon content, which minimizes carbide precipitation and enhances resistance to intergranular corrosion.

Nickel plays several roles in the properties of stainless steel:

Corrosion Resistance: Nickel improves resistance to a range of corrosive environments, including acids and saltwater. It also enhances passivation, allowing the steel to form a stable oxide layer that prevents corrosion.

Mechanical Properties: Nickel contributes to improved ductility and toughness, especially at low temperatures, which is critical in cryogenic and offshore applications.

Fabrication and Weldability: Austenitic stainless steels are easier to weld and form than ferritic grades, offering better productivity and reduced labor costs in fabrication.

Thermal Stability: Nickel enhances performance at elevated temperatures, a key factor in power plants, refineries, and chemical plants.

Chemical Processing: Handles acids and aggressive fluids

Offshore Platforms: Exposed to seawater and extreme conditions

Pharmaceutical/Biotech: Demands ultra-clean, corrosion-resistant systems

Nickel is also a strategic commodity. Market trends, supply chain issues, and global demand fluctuations all influence the cost and availability of stainless steel.

Electric Vehicle (EV) Batteries: Nickel is a core component in nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) battery chemistries used in electric vehicles. As of 2024, batteries accounted for about 30% of global nickel demand, with forecasts suggesting this could rise to 50% by 2030.

Supply Chain Volatility: Nickel supply is highly concentrated in countries like Indonesia, the Philippines, and Russia. Export restrictions, environmental regulations, and geopolitical risks can constrain supply and drive prices up.

Speculative Trading and Stockpiling: Commodities markets often experience volatility due to speculative trading. In March 2022, for example, nickel prices surged over 100% in just two days, causing turmoil in stainless steel markets.

Impacts on PVF Wholesalers

Impacts on PVF Wholesalers Rising Costs: Stainless steel prices often rise in parallel with nickel price spikes.

Availability Risks: Supply bottlenecks can result in extended lead times for 316 and 316L components.

Inventory Strategy: Wholesalers may need to diversify stock with low-nickel grades or increase safety stock levels to buffer against delays.

Stainless steel manufacturers are not the only players relying on nickel. Competition comes from several sectors:

1. Battery Manufacturing (EVs, Energy Storage)

Uses high-nickel cathodes (NMC 811, NCA)

Demand expected to grow by over 10% annually

Directly competes with PVF-grade stainless steel for high-purity nickel

2. Other Stainless Steel Applications

Construction (beams, supports)

Food-grade equipment (sinks, cookware)

Medical devices (surgical instruments)

It is important to note that all of these industries compete for grades like Type 304 and Type 316.

3. Nickel-Based Superalloys (Aerospace & Energy)

Used in jet engines, nuclear reactors, and gas turbines

Require 50–70% nickel by weight

Though smaller in volume, the need for high-purity nickel affects the broader supply chain

4. Plating and Catalysts

Electroplating and chemical catalysts use nickel salts

Accounts for ~5–10% of total demand

5. Emerging Technologies

Hydrogen fuel systems and electrolyzers use nickel

As renewable energy initiatives grow, so does this demand

Implications for PVF Wholesalers:

Implications for PVF Wholesalers: Nickel competition from EV and aerospace sectors can limit stainless steel availability. This may result in price increases and longer lead times for 304/316 stainless steel piping products. Develop relationships and partnerships with mills to secure inventory during shortages.

Track Market Trends: Monitor nickel prices through the LME (London Metal Exchange) or news from the Nickel Institute to stay ahead of cost fluctuations.

Inventory Diversification: Maintain a mix of high and low nickel stainless steel products to manage risk and offer flexible options to clients.

Educate Customers: Explain the value of nickel containing grades for performance critical applications. Offer low nickel alternatives when appropriate.

Strengthen Supplier Relationships: Strong partnerships with mills and distributors improve your position when distributing becomes tight.

Plan Ahead: Use forecasting tools to predict customer demand and align procurement strategies with market cycles.

Nickel is a cornerstone of high-performance stainless steel, and its role in the PVF industry cannot be overstated. As global competition for nickel intensifies PVF wholesalers must understand how nickel affects stainless steel properties, pricing, and availability.

By tracking nickel market trends, diversifying inventory, and educating customers, wholesalers can remain competitive while delivering reliable, high-quality piping solutions.

Ready to learn more about our stainless steel and nickel? Contact our team today. Learn more about how Merit can help you stay informed on market trends and insights that impact stainless steel.

8/18/2025 10:19:57 AM